China Investment Strategy/Emerging Markets Strategy

2024 Key Views: China Is In A Deflationary Trap

By Arthur Budaghyan

Thank you for your interest in BCA Research’s China Investment Strategy and Emerging Markets Strategy designed to help investors understand the China/EM landscape by merging global research with country specific insights, benefitting both global asset allocators, and dedicated EM portfolios.

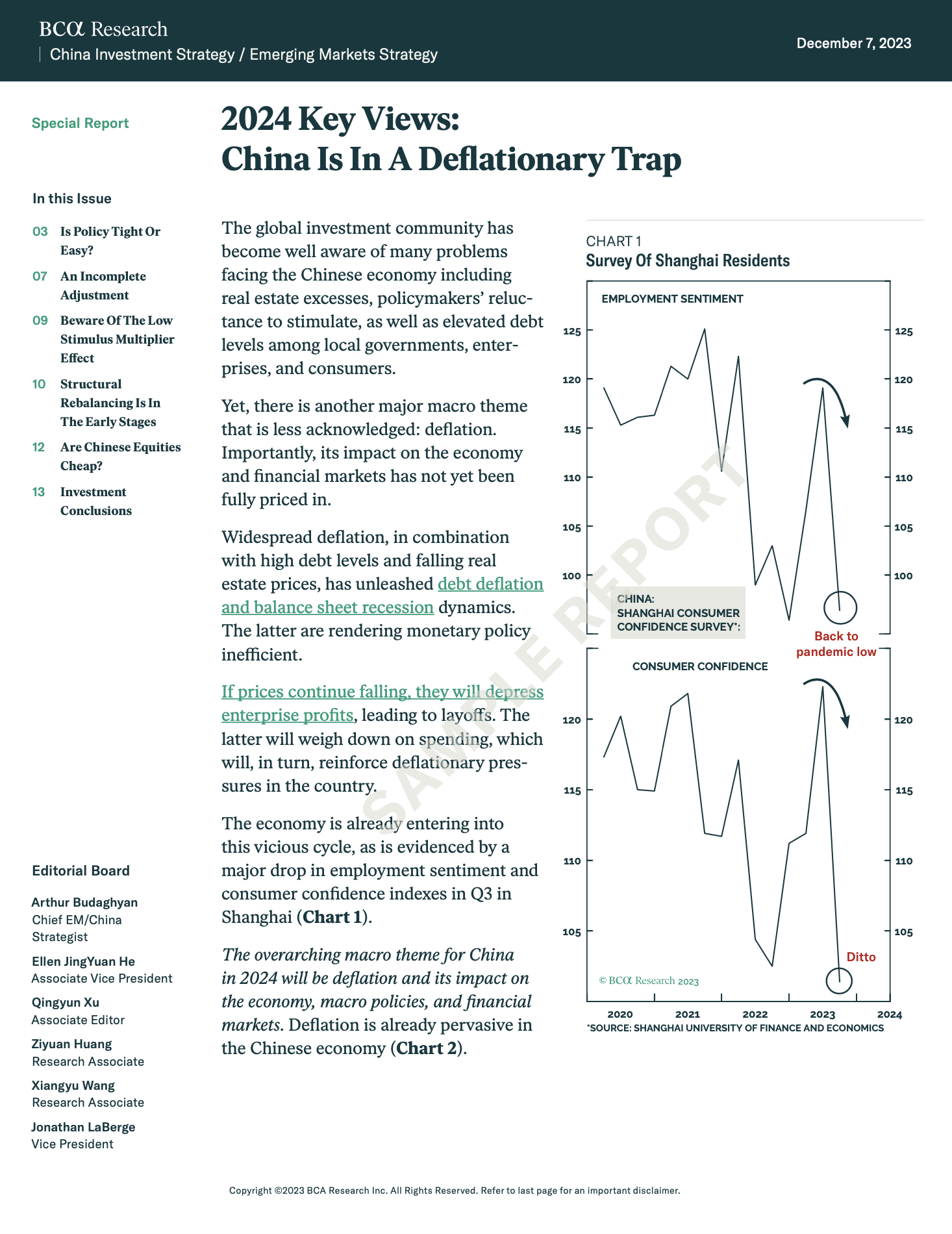

The overarching macro theme for China in 2024 will be deflation and its impact on the economy, macro policies, and financial markets. Widespread deflation, in combination with high debt levels and falling real estate prices, had unleashed debt inflation and balance sheet recession dynamics.

To access a sample of the report “2024 Key Views: China Is In A Deflationary Trap,” please complete the form fill with your contact information.

If you are interested in a complimentary trial, we invite you to contact sales@bcaresearch.com.

About BCA Research

BCA Research is the leading independent provider of global investment research. Since 1949, BCA Research’s mission has been to support its clients in making better investment decisions through the delivery of leading-edge analysis and forecasts of all major asset classes and economies, as well as actionable macroeconomic research.

BCA provides its global investment research services to financial institutions, corporations and investment professionals across six continents. The firm maintains its head office in Montreal, with local offices in major financial centers around the world.