How To Win During "Higher For Longer"

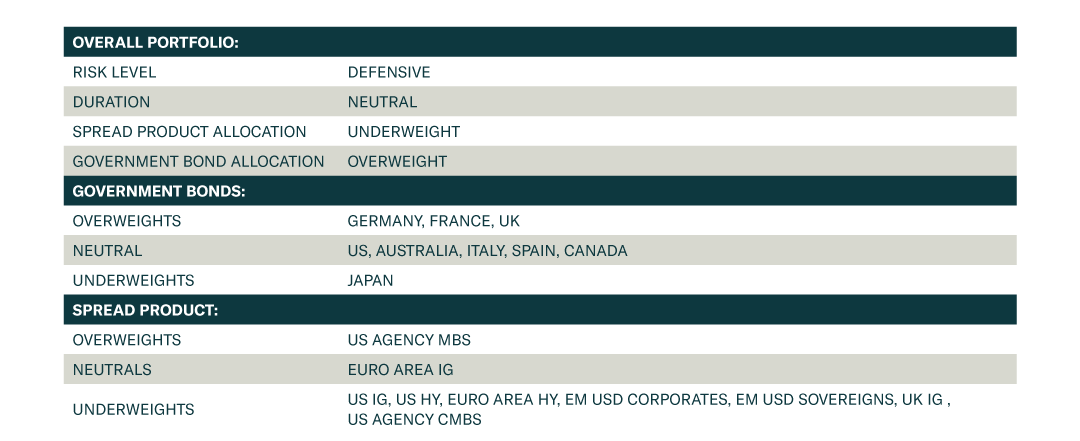

Our recommended model bond portfolio modestly underperformed its custom benchmark index by -8bps in Q3/2023. The portfolio gained from high-conviction underweights in US investment grade, EM hard currency debt & JGBs. This partially offset the hit to performance from above-benchmark duration exposure as global bond yields rose during Q3. Looking ahead, the portfolio is positioned to benefit from our base case scenario for the next 6-12 months: slowing global growth, easing inflation pressures, an end to tightening cycles of major central banks and a deteriorating global credit cycle.