Russian Oil Embargo?

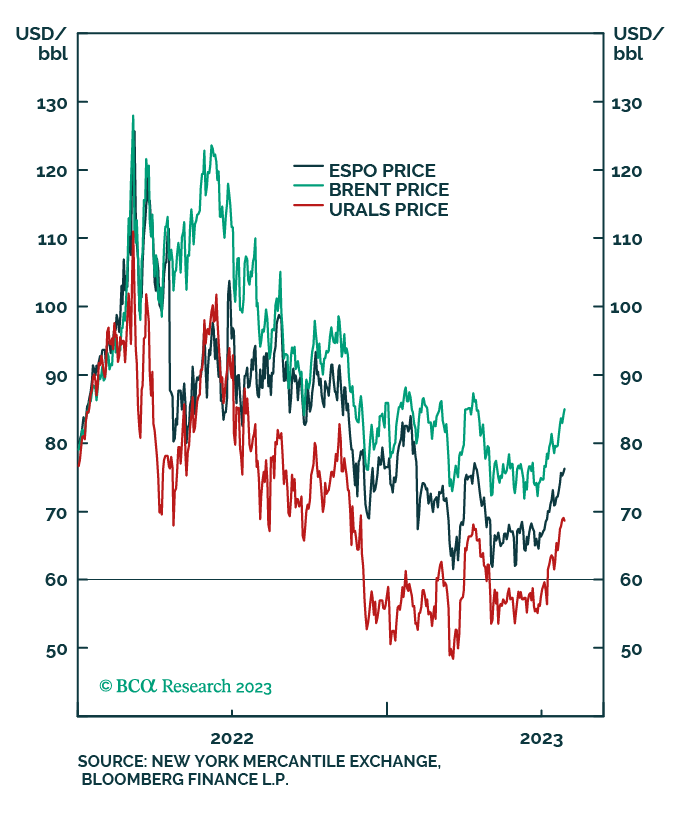

Markets will start discounting a larger cut to Russian crude oil output going into 4Q23. How the endgame of Ukraine’s war unfolds and US presidential elections, which Russia will actively seek to undermine, will be key to the timing and size of these cuts. OPEC 2.0 likely will not offset Russian cuts unless Brent trades through $140/bbl next year, in our view. Tightening markets will push Brent above $90/bbl this year, in line with our forecast, and keep Russian benchmarks – Urals and ESPO – above the G7’s $60/bbl price cap.