Inflation expectations are based on the past ten years of experience, and they will remain anchored if inflation remains low. Central banks must pull current inflation sharply lower to maintain this...

26 April 2023

Why Is Expected Inflation So Low? 4.26.2023

19 April 2023

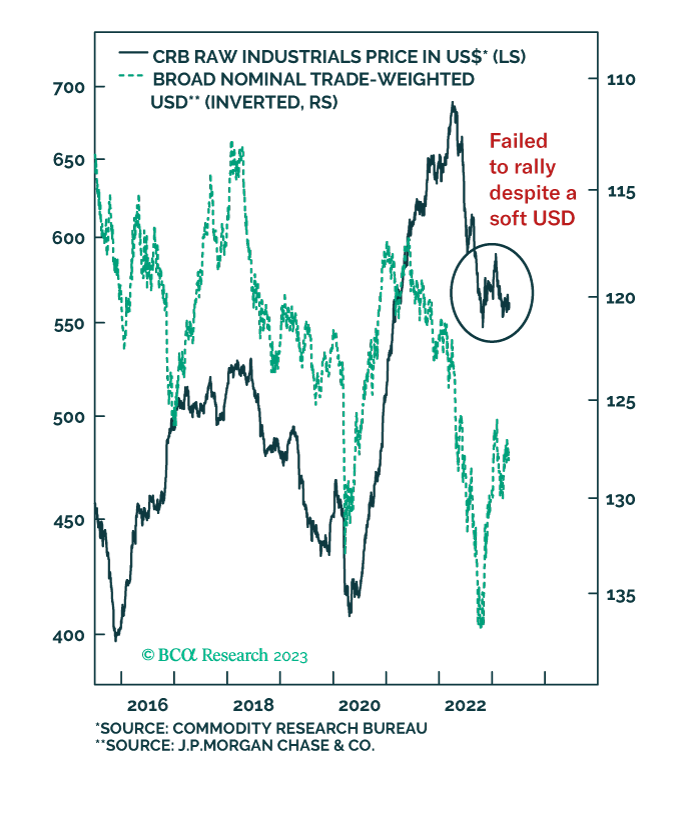

Expectations Of A US Dollar Demise Are Premature

The U.S. dollar has been weak in recent months, but it may be about to rebound. The dollar has depreciated against low-yielding currencies like the euro, Swiss franc, and Japanese yen. However, it...

17 April 2023

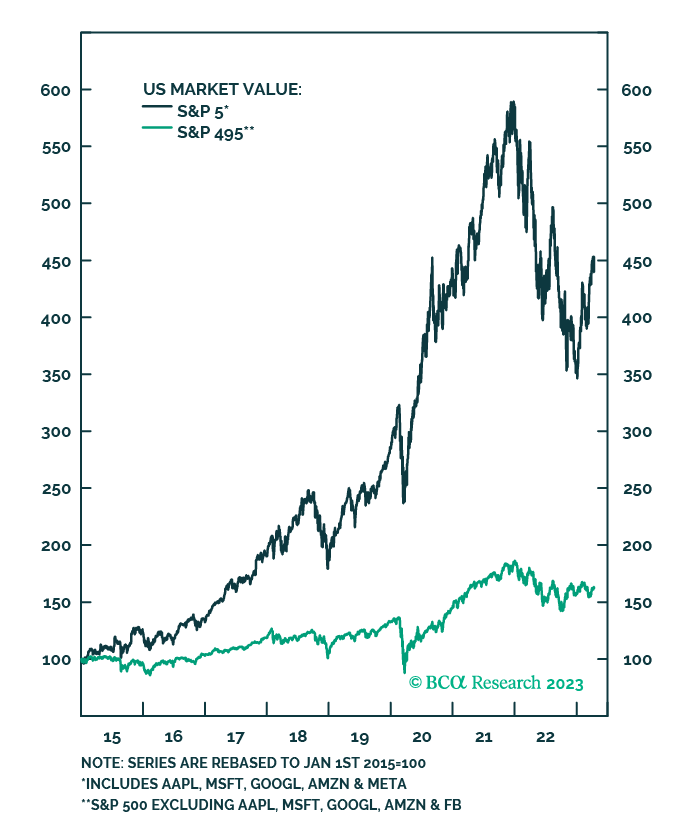

Gulliver In The Land Of Giants: Revisiting Market Concentration And Growth Vs Value

13 April 2023

Macro Investors Are About To Make A Huge Mistake

01 March 2023

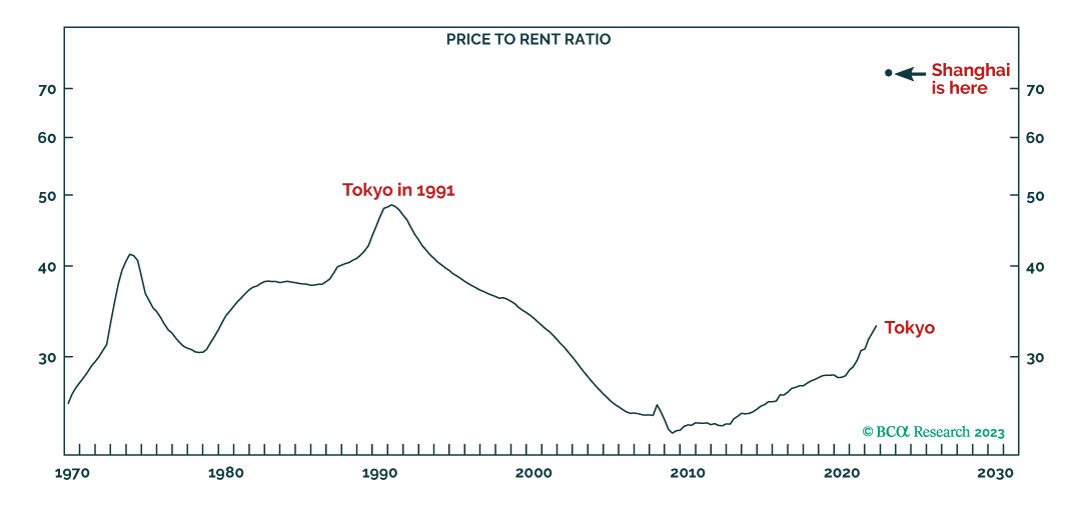

China’s $100 Trillion Housing Bubble Reaches Its Limit

24 February 2023

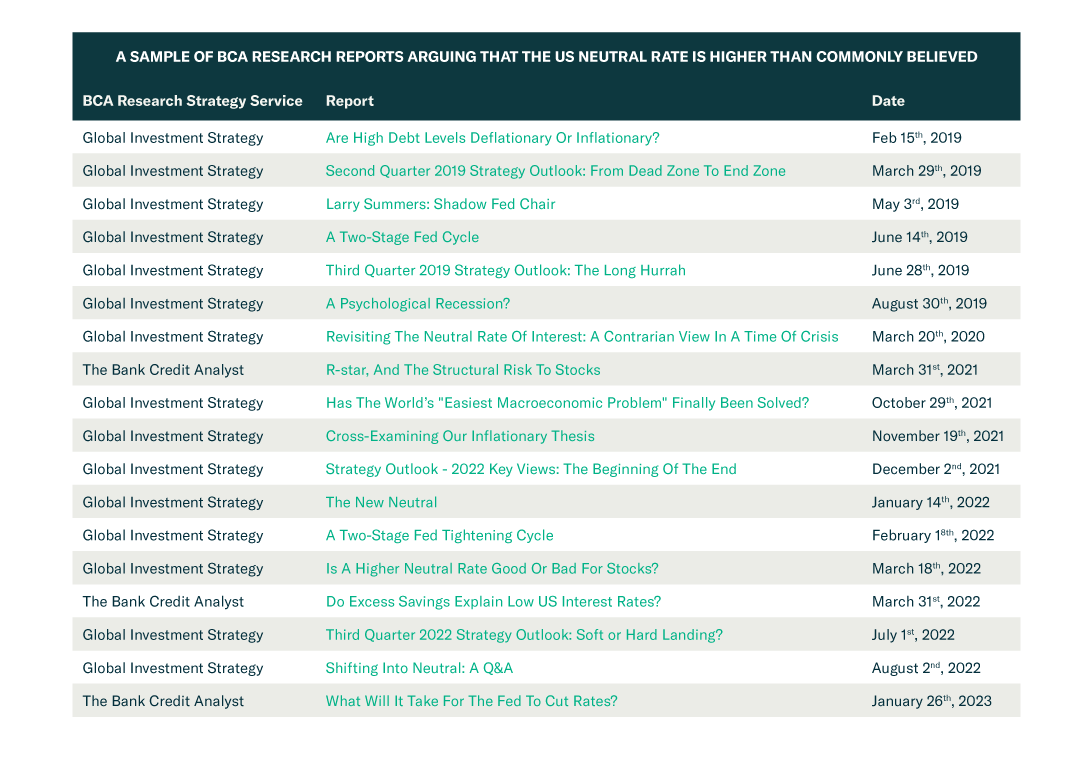

The Fed’s Low Neutral Rate View: Fact Or Folly?

14 January 2023

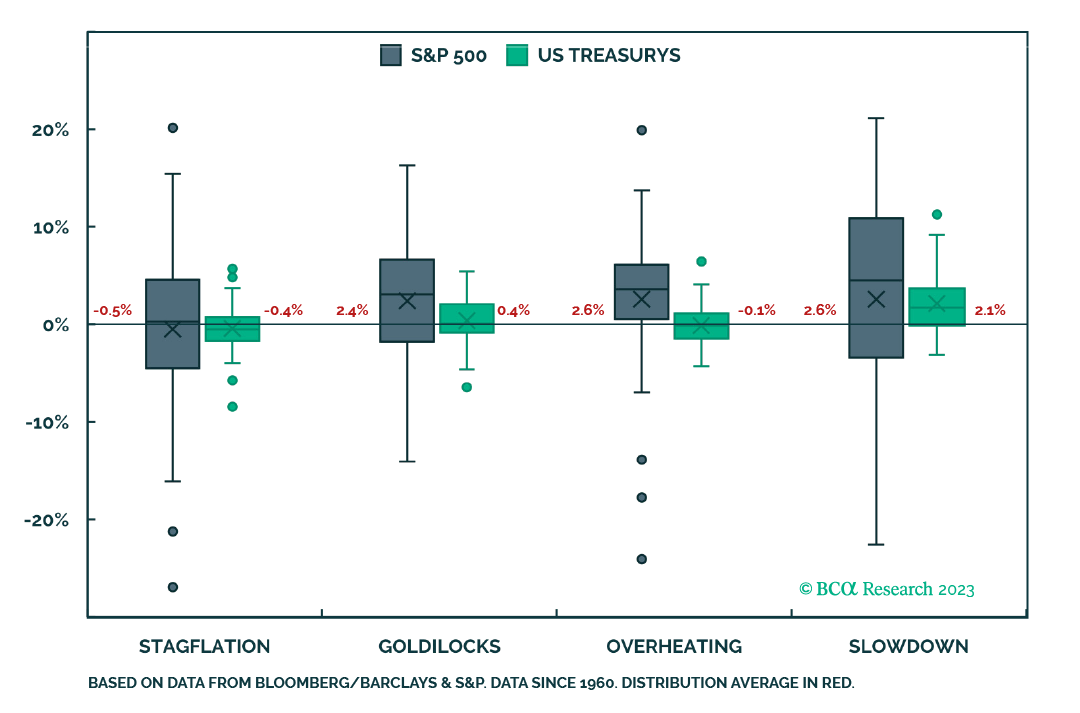

All-Weather Investing: The Effect Of Inflation And Growth On Returns

01 December 2022

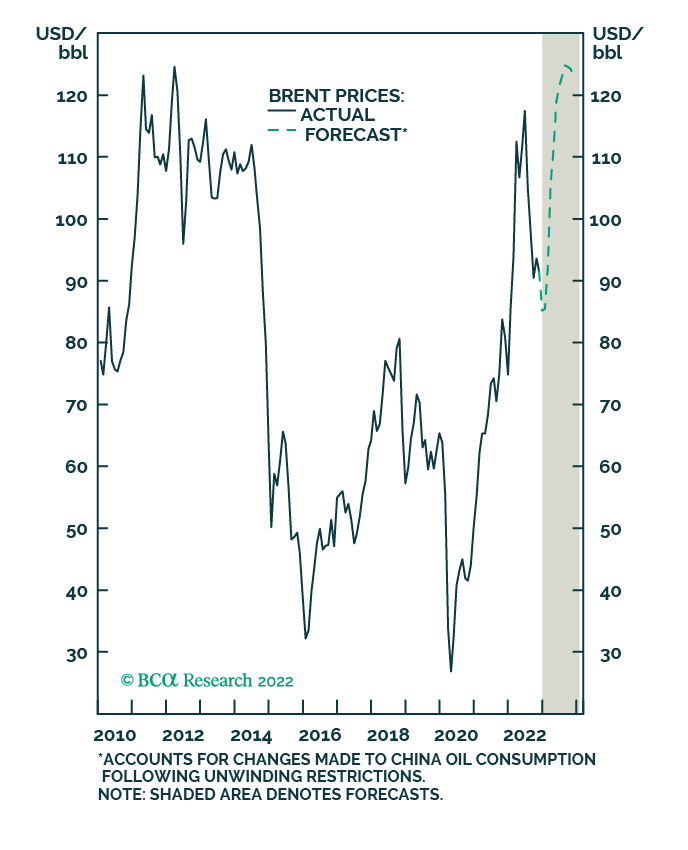

The Only Thing Missing Is An Asteroid: Unprecedented Uncertainty In Commodities

We are revising our 4Q22 Brent forecast to $90/bbl, expecting December front-line Brent to average $85/bbl. On the back of this early weakness, we are lowering our 2023 forecast slightly to $115/bbl,...

01 December 2022

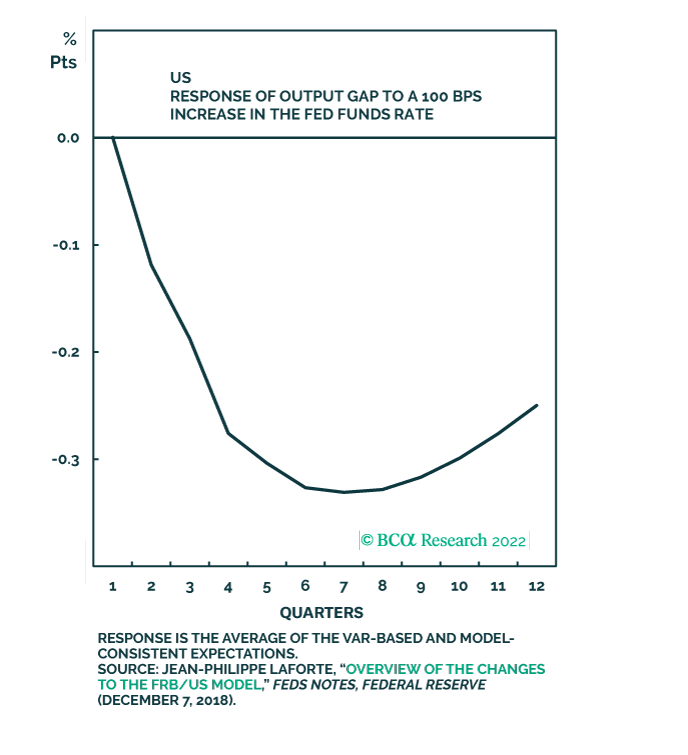

Lags and Consequences

As the FOMC explicitly acknowledged this week, monetary policy operates with substantial lags. We see the risks to stocks as tilted to the upside over the next 6 months but are neutral on global...

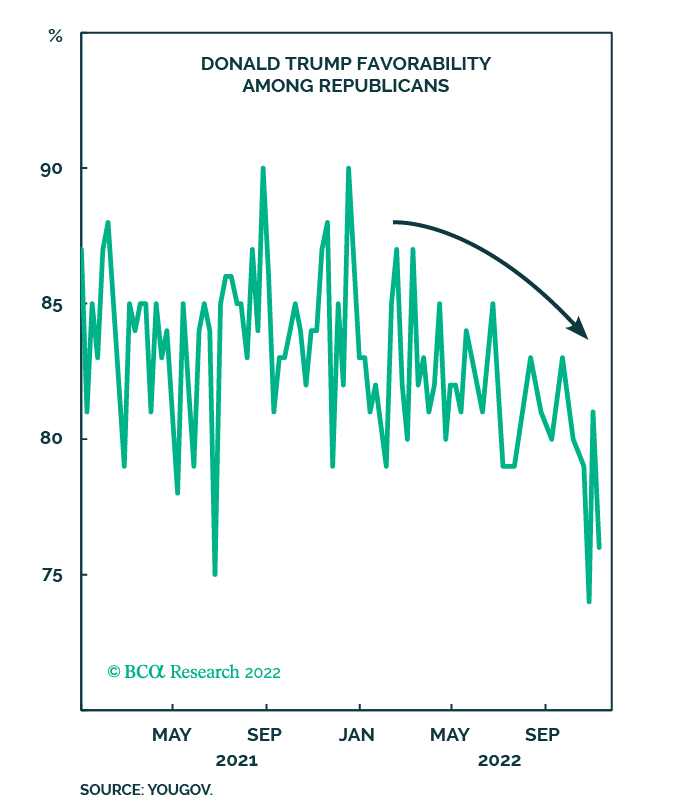

21 November 2022

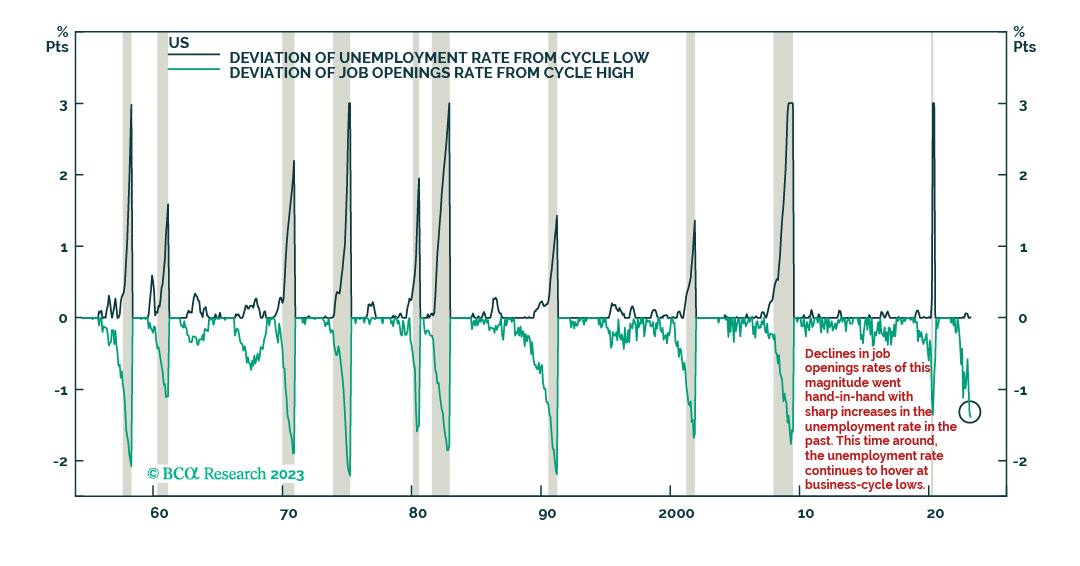

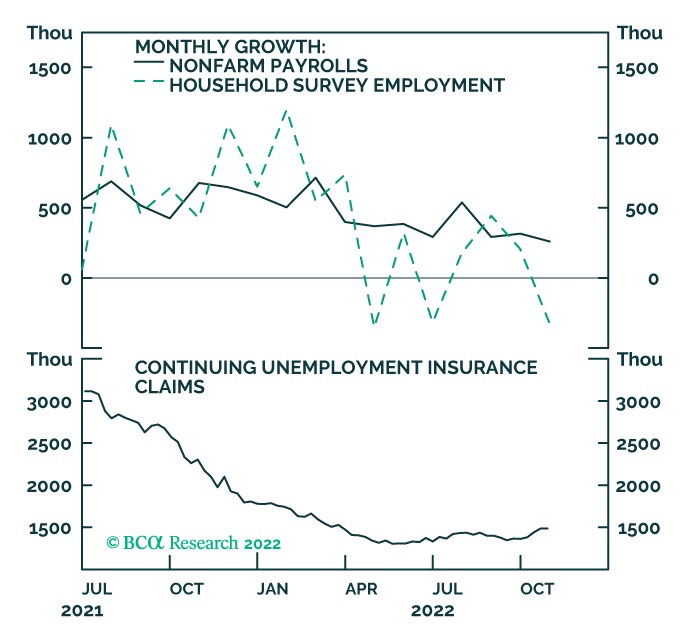

The Labor Market is Cooling

Nonfarm payrolls delivered yet another strong showing in October, rising by a robust +261k on the month. However, looking beyond the headline figure we are now finally starting to detect some signs...