21 July 2023

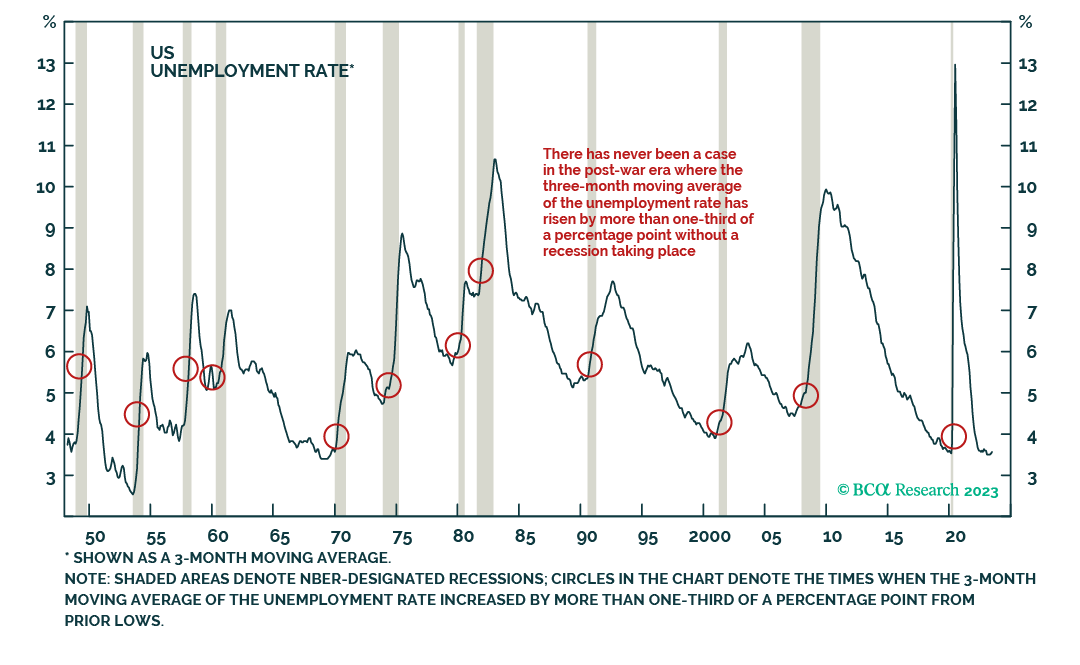

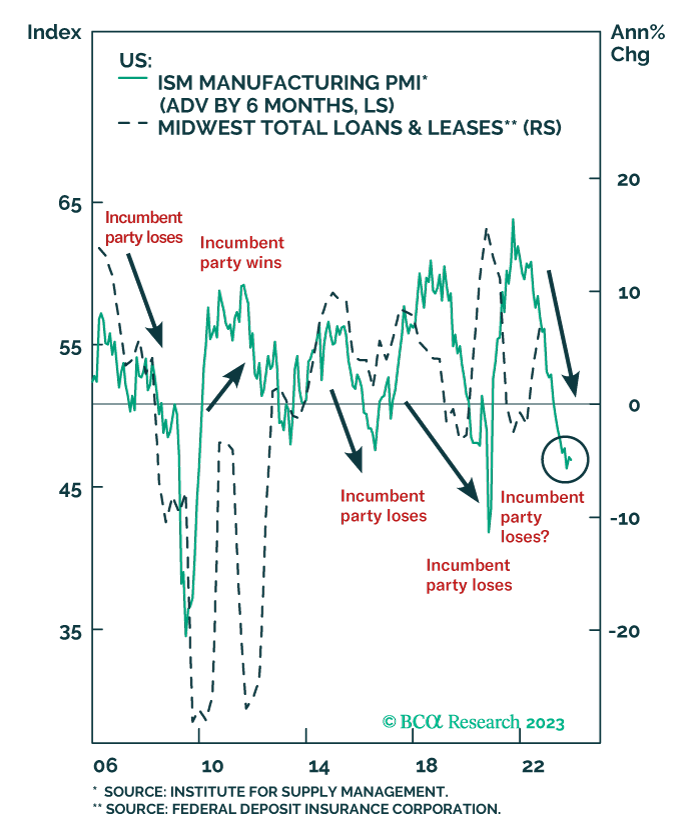

Three Scenarios In Which The US Can Avoid A Recession

We are in the “This Time is Longer” camp rather than the “This Time is Different” camp, meaning that we expect the US to enter a recession, but later than most people are anticipating. Could we be...

17 July 2023

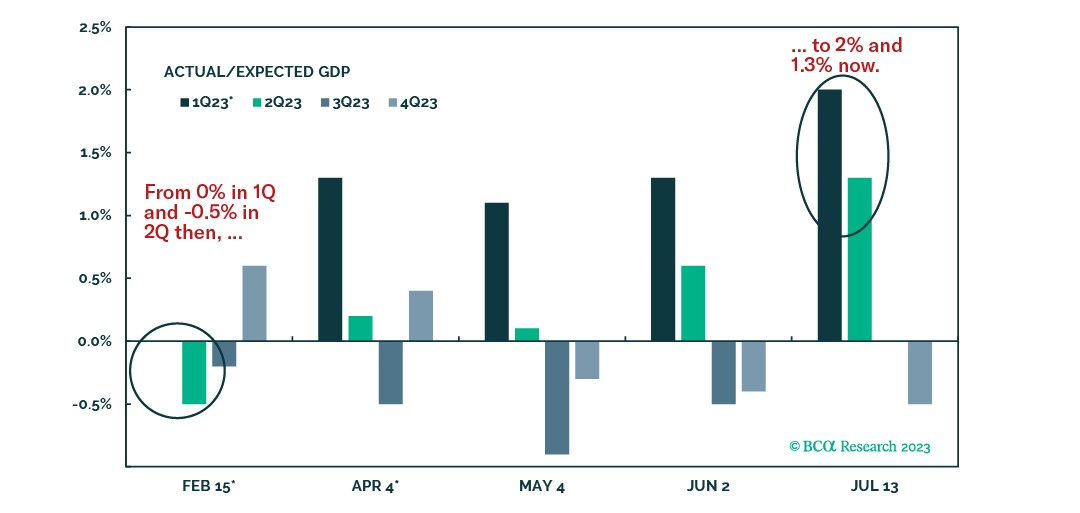

Recalibration

The process of upwardly revising consensus economic expectations and pushing back recession ETAs has begun but is not yet complete. The recalibration will ultimately prove to be self-limiting for...

17 July 2023

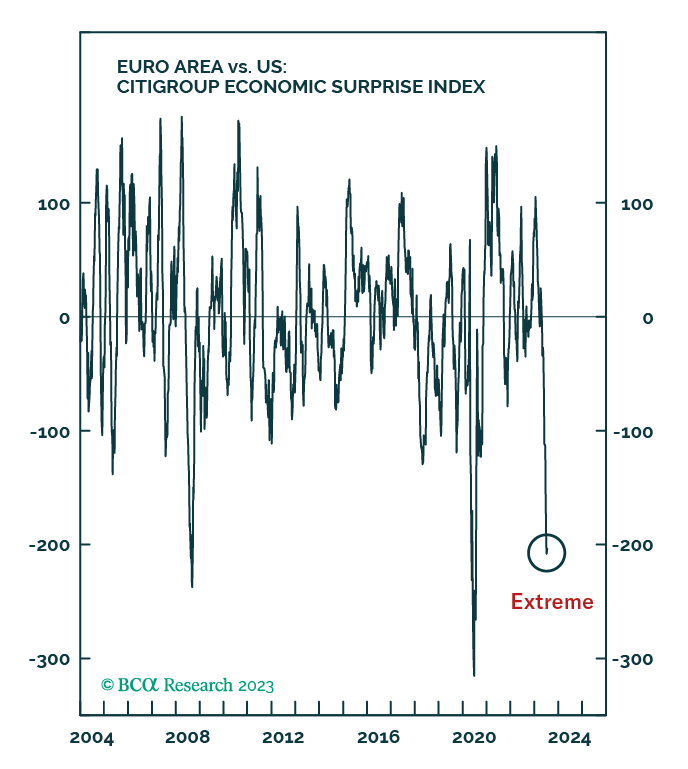

How Large Can The Eurozone / US Divergence Get?

Euro Area growth has fallen sharply in recent months, resulting in a collapse of European economic surprises compared to the US. This transatlantic growth divergence was driven by the rapid decline...

17 July 2023

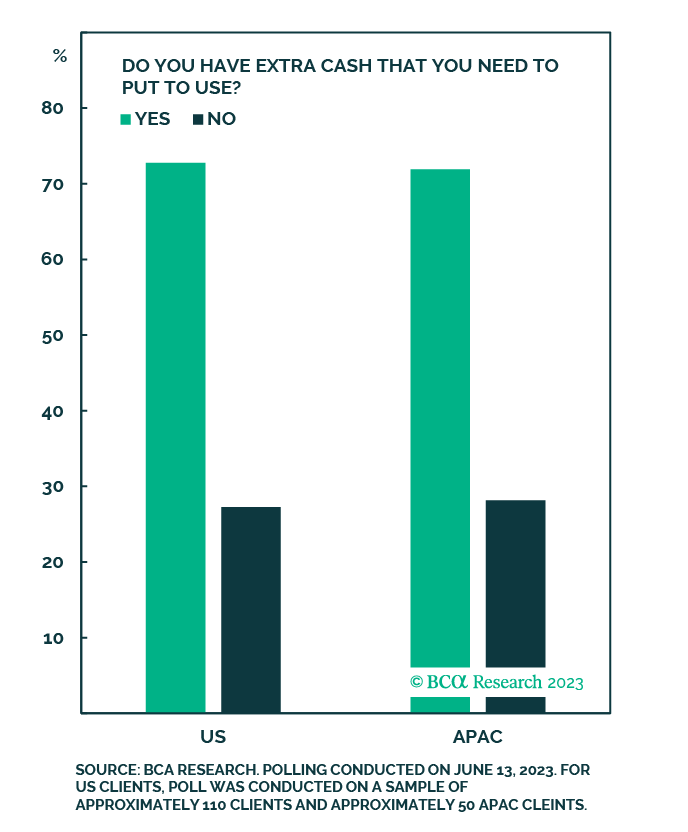

Driving The Future: Revisiting EVs And Green Energy

The rally is broadening, spurred by a batch of positive economic news, significant cash balances, and investors’ FOMO. Investors are channeling funds into cheap areas of the market. Small has...

30 June 2023

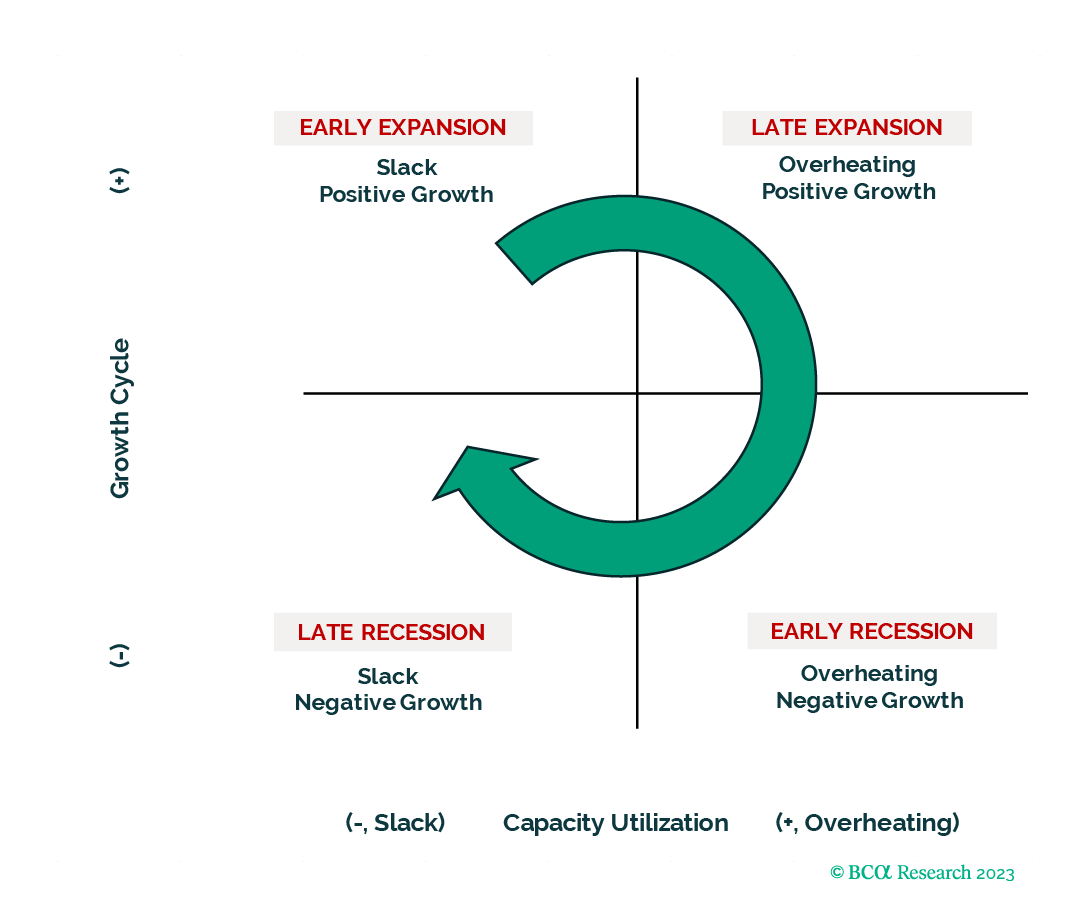

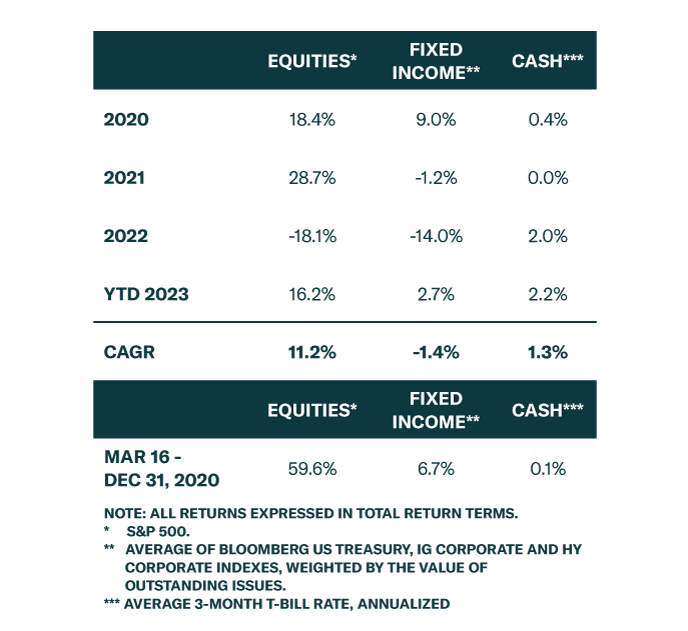

A Macro Playbook For Asset Allocators

A global recession continues to be likely over the next 12 months. The impact of tighter US monetary policy is slowly being felt. The economies of Europe and China are even more of concern,...

29 June 2023

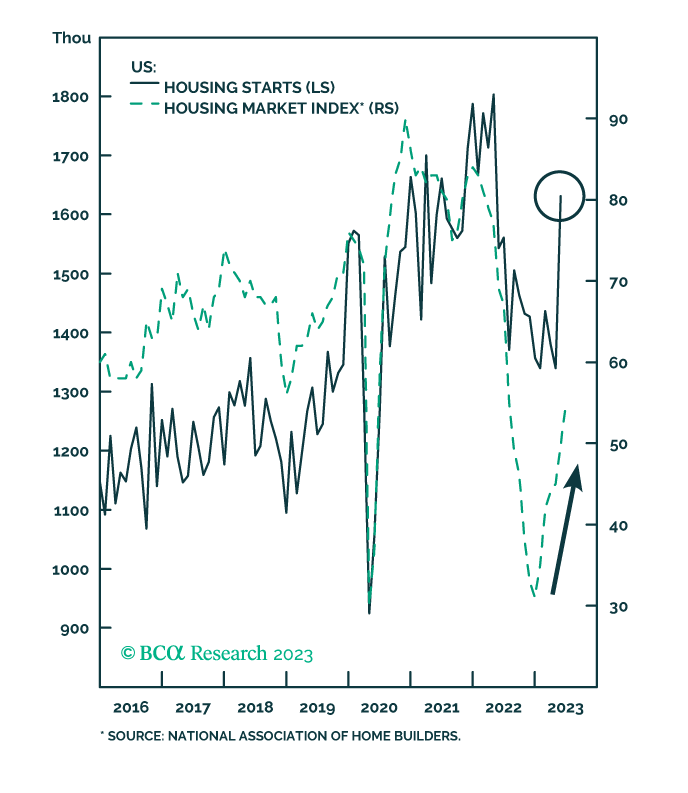

An Update On The US Housing Market

Recent US housing market data has signaled a potential turnaround in housing construction and new home sales. Permanent site residential structures investment may begin to contribute positively to US...

27 June 2023

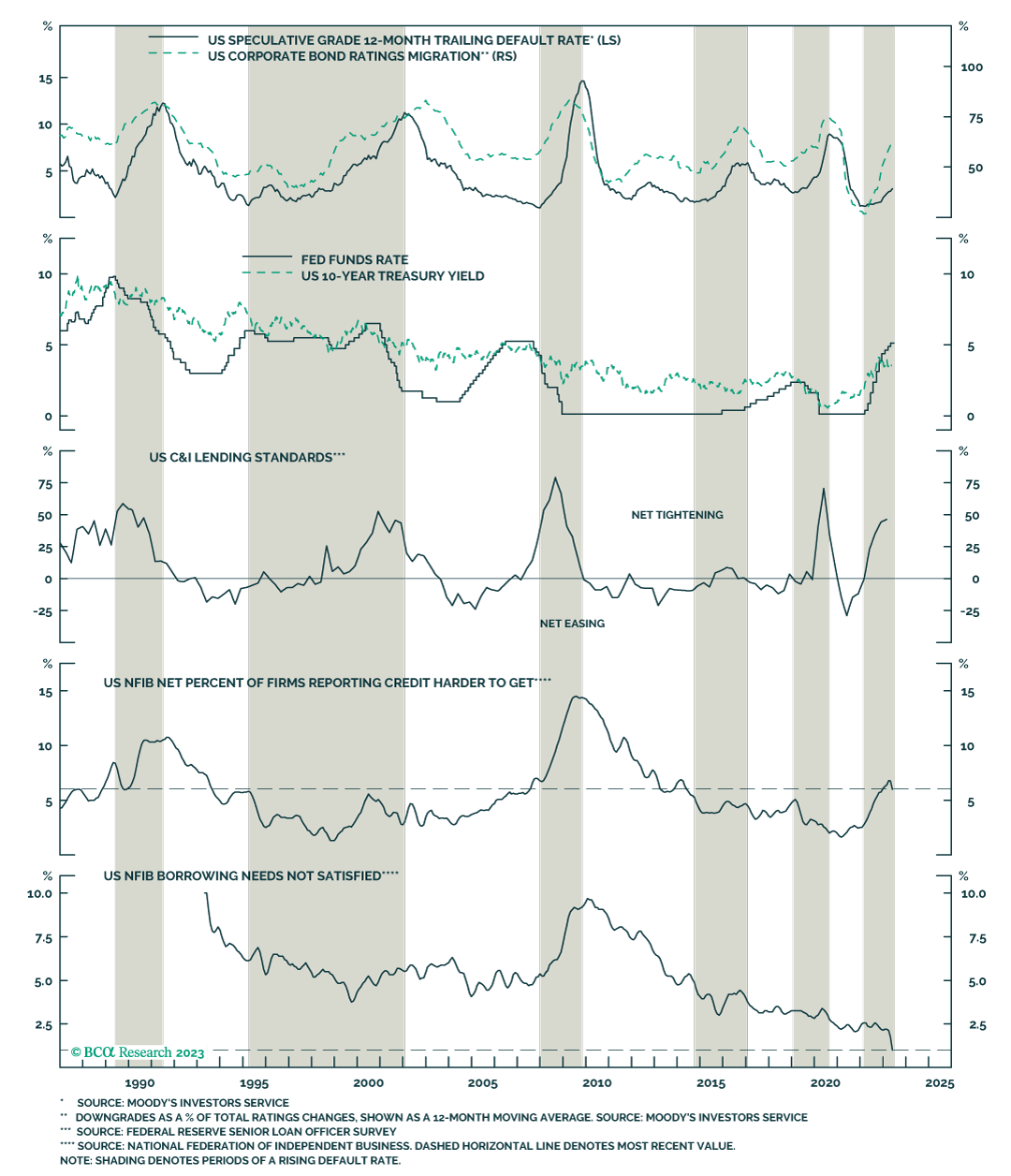

Credit Cycle Checkup

US corporate bonds have performed well during the past few months despite a backdrop of deteriorating credit fundamentals, i.e. a rising default rate and ratings downgrades outpacing upgrades. We...

23 June 2023

So Much For Détente?

Talks of a détente are premature and there is no domestic political basis in China or the US to support a true détente. Investors should not underappreciate global risk, on the basis of a détente,...

20 June 2023

So Far, So Good On The Road To 4,500

We remain tactically overweight equities but are preparing to transition to equal weight once the S&P 500 reaches 4,500. Although the index may well peak above our target, we do not expect the rally...

19 June 2023

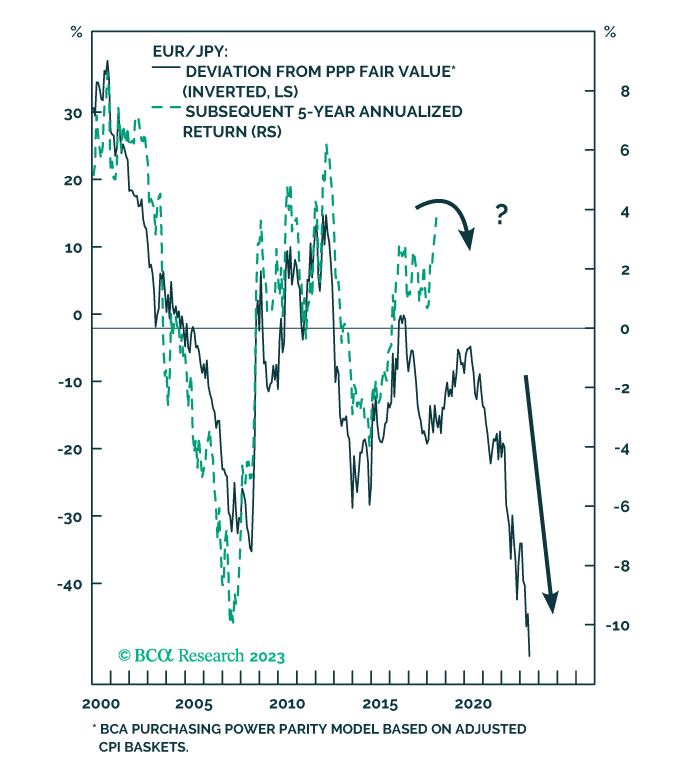

The ECB and BoJ Diverge: Implications For Markets

Last week was a busy one for the major central banks in the G10. We have already discussed the bond and FX implications of the Fed’s “hawkish hold” in a previous Insight . In this new Insight, we...