21 December 2023

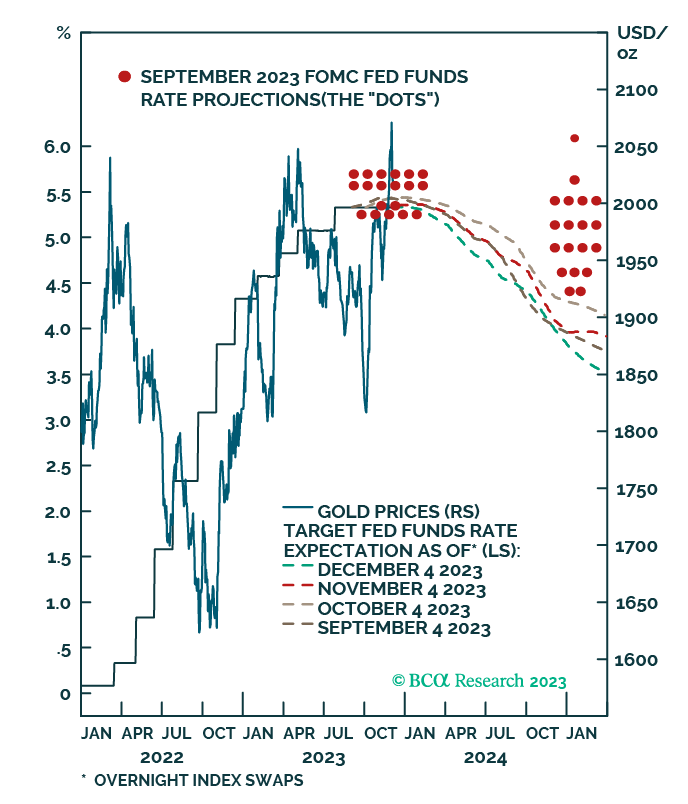

All That Glitters, And Then Some

The Fed will not cut interest rates as aggressively as markets expect, but will again reiterate its intent to keep rates higher-for-longer. This will not undermine US GDP growth next year, although a...

13 November 2023

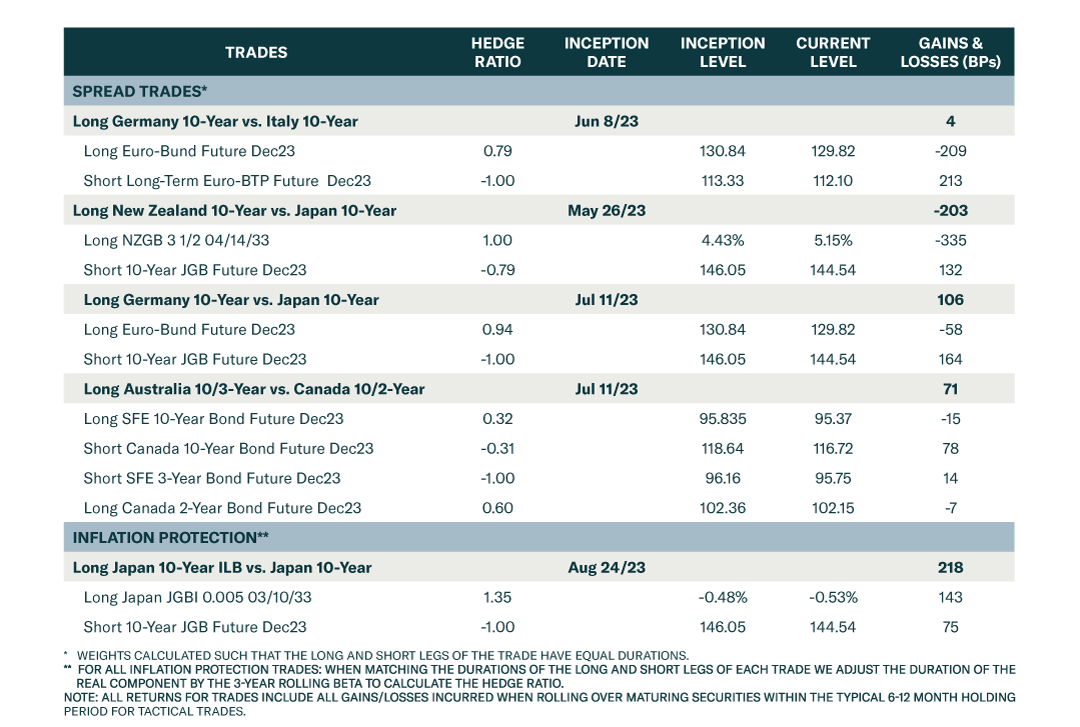

A Review Of Our Current Tactical Trade

This trade mirrors our two highest conviction strategic views in government bond space, overweighting core European government debt and underweighting Japanese government bonds (JGBs). This is a pure...

09 November 2023

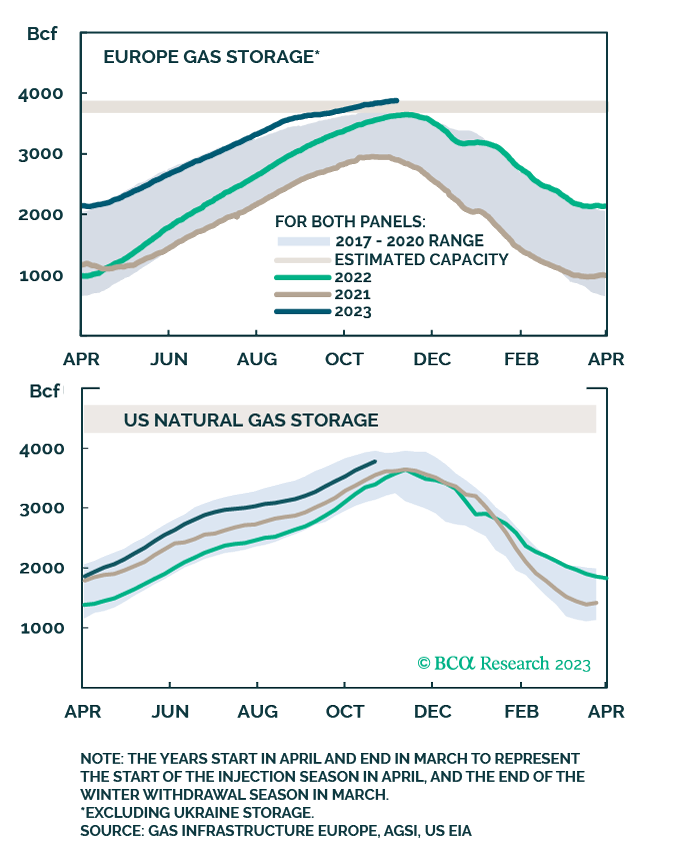

Higher For Longer Natgas Demand

Natural gas storage levels in the US and EU are sufficient to balance flowing supply and demand this winter, assuming normal weather. China continues to invest in domestic production, and to...

23 October 2023

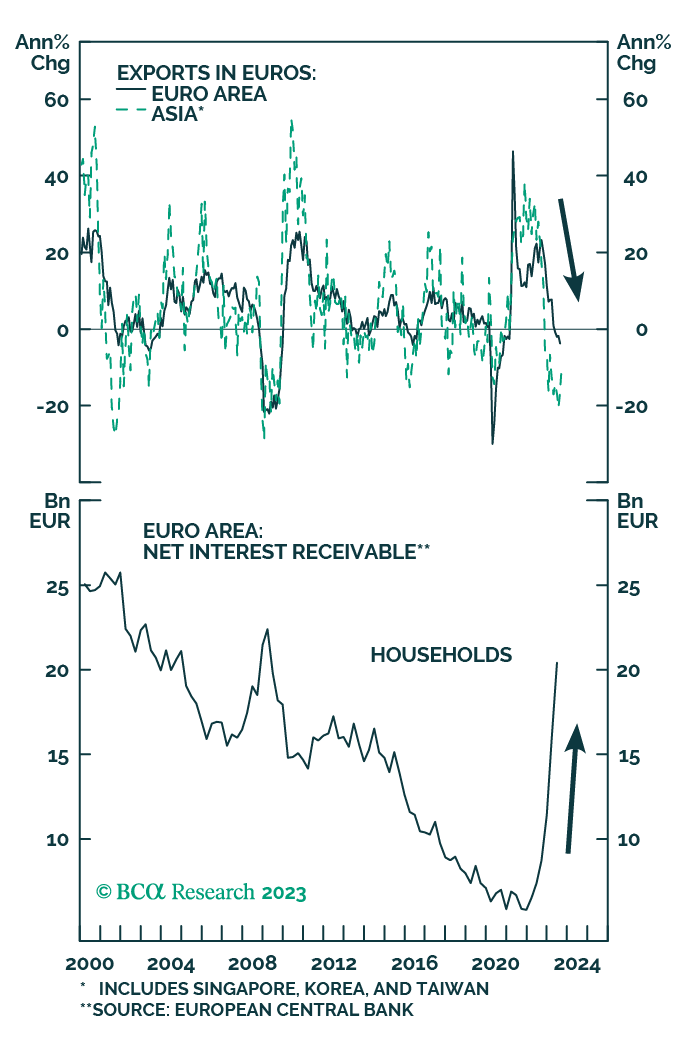

Eurozone: Recession Postponed, Not Cancelled

The weakness in Eurozone economic activity this year is not about the ECB’s monetary policy. Rather, it reflects the weakness in the global industrial cycle and the depressing effect of an inflation...

19 October 2023

2024: The Year Of The Yen

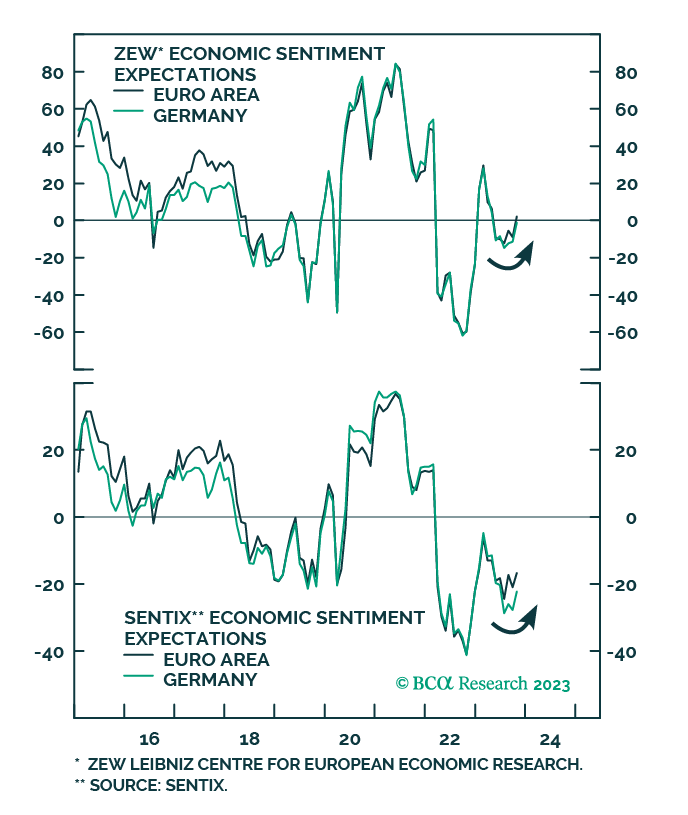

Global growth has firmed over the past few months, with US consumption remaining resilient, Chinese activity data surprising on the upside, and tentative signs of hope emerging from the latest ZEW...

18 October 2023

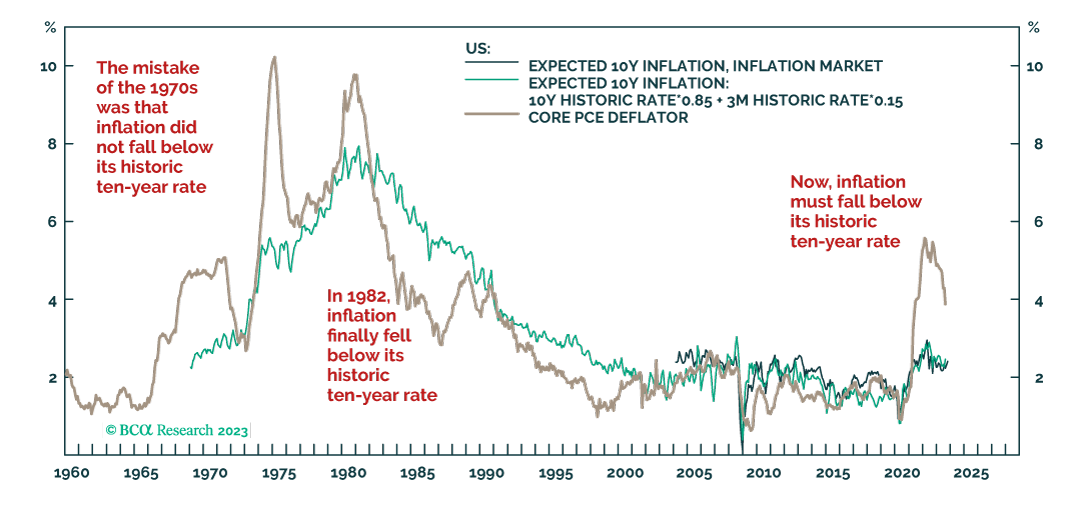

Avoiding The Mistakes Of The 1970s

A fundamental question for investors is, will central banks fail to exorcise the pandemic’s lingering inflationary shock, just as they failed to exorcise the inflationary shock that came from the...

17 October 2023

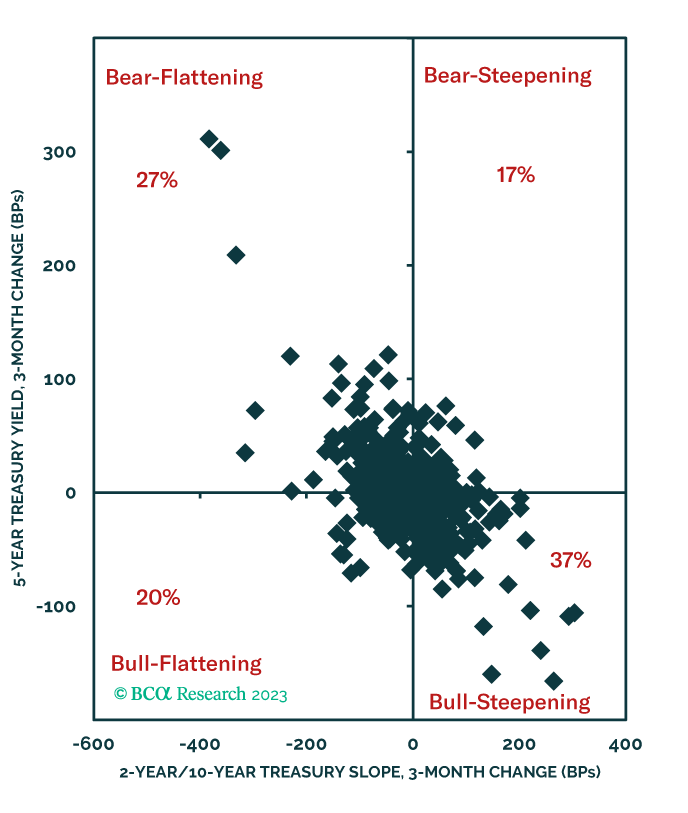

Does The Bear-Steepener Have Legs?

The recent bear-steepening of the US Treasury curve has been driven by the combination of stronger-than-expected economic growth and stable Fed rate expectations. Historically, such periods do not...

17 October 2023

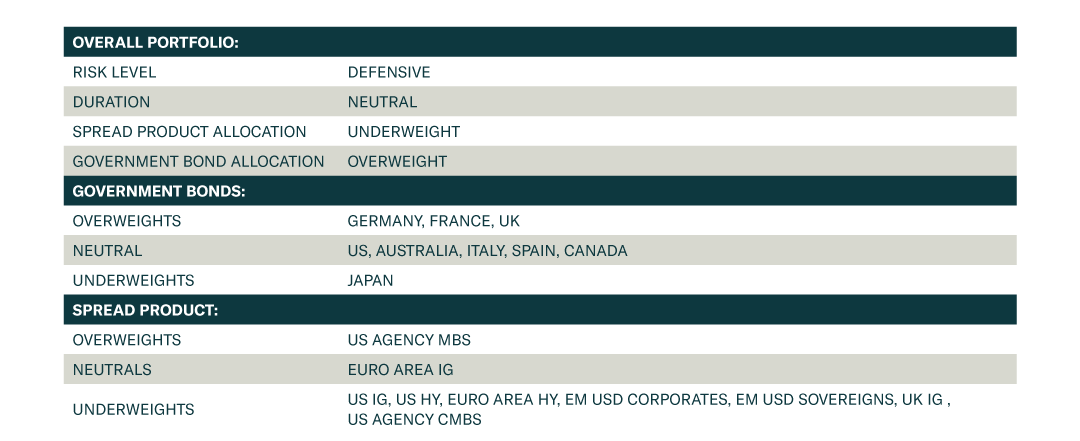

How To Win During "Higher For Longer"

Our recommended model bond portfolio modestly underperformed its custom benchmark index by -8bps in Q3/2023. The portfolio gained from high-conviction underweights in US investment grade, EM hard...

17 October 2023

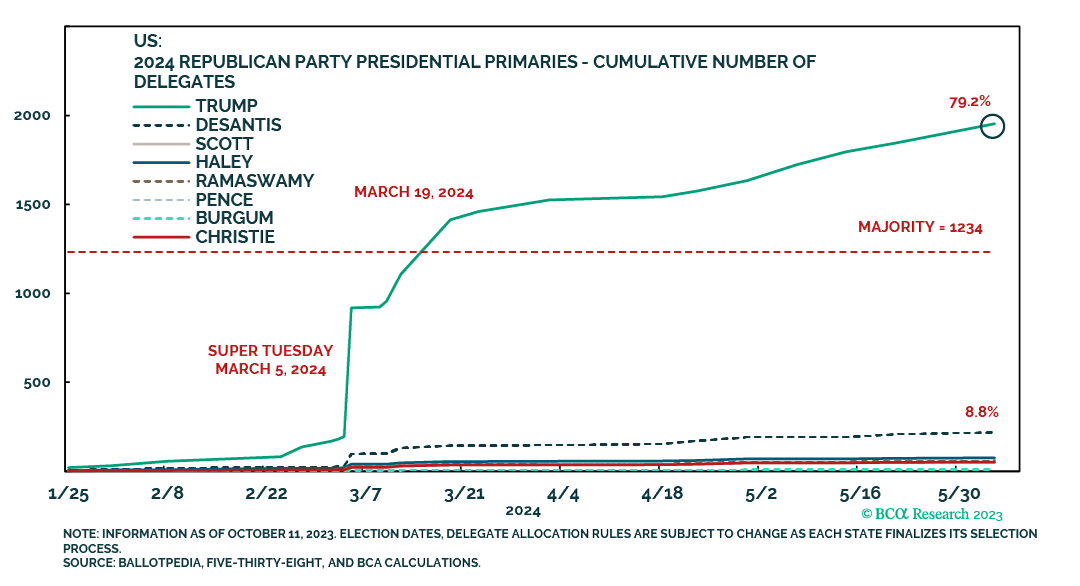

The Math Behind Trump’s Nomination

Trump is lined up to win the Republican presidential nomination by March 19, 2024. That is the implication from public opinion polling in key states, projected across the US’s major regions and...

13 October 2023

Bonds Are Great Again

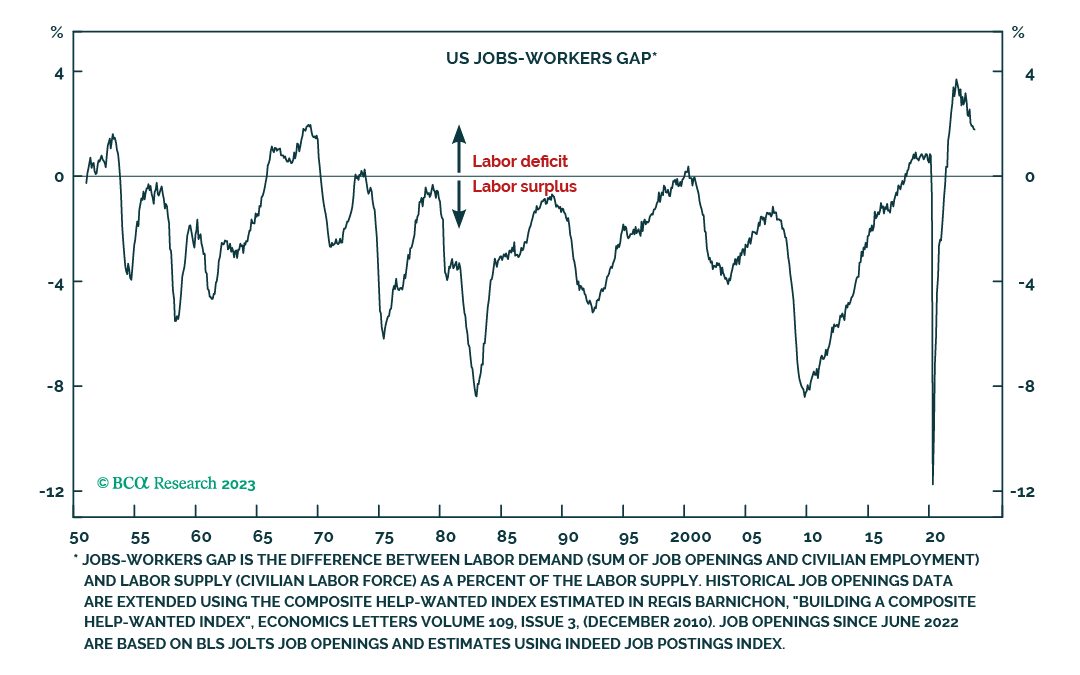

After being in the bear camp, we have become bond bulls. Many investors have concluded that US monetary policy is not yet restrictive because employment has remained resilient. This is fallacious...